09/02/2024

Carbon Accounting Explained: Achieving Sustainability in Business

Discover the essentials of carbon accounting, a key strategy in the fight against climate change.

23 February 2024

In the face of escalating climate change concerns, the quest for effective carbon mitigation strategies has intensified. Among the plethora of approaches to curb greenhouse gas (GHG) emissions, carbon offsets and carbon credits have emerged as pivotal mechanisms. Both play crucial roles in the global effort to combat climate change, yet they operate within different frameworks and serve distinct purposes. Understanding these instruments is vital for businesses, governments, and individuals alike, as they navigate the complexities of environmental stewardship and strive towards a more sustainable future.

Carbon offsets and credits are often mentioned in the same breath, yet their nuances and applications bear significant implications for their effectiveness and impact. At their core, both approaches aim to reduce the net amount of carbon dioxide (CO2) and other GHGs in the atmosphere. However, their methodologies, market dynamics, and integration into broader climate policies diverge, offering unique pathways to environmental conservation and emission reduction.

Table of Contents:

1. Understanding Carbon Offsets

2. Understanding Carbon Credits

3. Differences Between Carbon Offsets and Credits

4. Role in Climate Change Mitigation

5. Regulatory and Policy Frameworks

6. Consumer Awareness and Participation

7. Conclusion

A carbon offset represents a reduction in emissions of carbon dioxide or other GHGs made to compensate for emissions made elsewhere. In essence, one carbon offset equates to the reduction or removal of one metric ton of CO2 from the atmosphere. These offsets are generated through various projects that either prevent the release of additional greenhouse gases, remove existing CO2 from the atmosphere, or enhance carbon storage capabilities.

The primary objective of carbon offsets is to enable individuals and organizations to mitigate their environmental impact. By investing in offset projects, entities can balance out their own unavoidable emissions, moving closer to carbon neutrality. This mechanism not only fosters global climate action but also supports sustainable development goals, such as biodiversity conservation, renewable energy adoption, and community development.

To ensure the integrity and effectiveness of carbon offsets, projects undergo rigorous verification and certification processes. These processes are conducted by third-party organizations, such as the Verified Carbon Standard (VCS) or the Gold Standard, which evaluate projects based on their ability to achieve real, measurable, and long-term GHG reductions. Certification assures buyers that the offsets contribute to genuine emission reductions and adhere to high environmental and social standards.

Carbon offsets offer a pragmatic approach to addressing climate change, providing flexibility for entities that face difficulties in immediately reducing their own emissions. They also stimulate investment in green technologies and sustainable practices worldwide. However, the concept of carbon offsets is not without criticism. Concerns include the potential for over-reliance on offsets instead of direct emission reductions, the challenge of ensuring additionality (ensuring projects result in additional emission reductions that would not have occurred otherwise), and the risk of non-permanence (the possibility that the carbon sequestered by a project, like a forest, could later be released back into the atmosphere).

Understanding carbon offsets involves recognizing their potential and limitations within the broader context of climate change mitigation. They represent a valuable tool in the global effort to reduce GHGs, but they must be part of a larger, multi-faceted approach to truly combat climate change effectively.

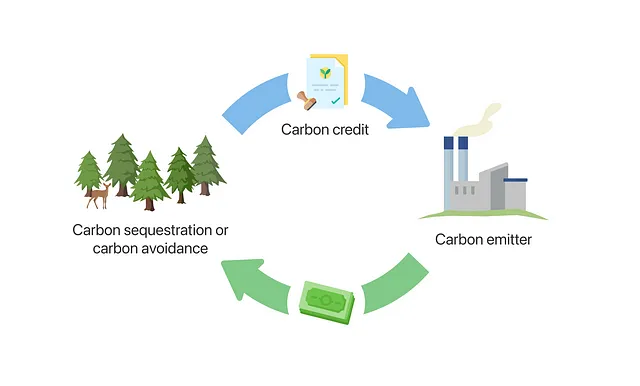

Carbon credits are permits that allow the holder to emit a certain amount of carbon dioxide or other greenhouse gases. One credit typically equals one ton of carbon dioxide (CO2) or an equivalent amount of other GHGs. Carbon credits can be bought, sold, or traded in international markets, and they are used primarily within regulatory schemes or carbon trading programs designed to limit or reduce greenhouse gases by major emitters.

The goal of carbon credits is to incentivize reduction in GHG emissions through a cap-and-trade system. Governments or regulatory bodies set a cap on the total amount of emissions allowed, and companies or organizations are allocated or can purchase carbon credits up to the cap limit. If they emit less than their allowance, they can sell their excess credits; if they emit more, they must buy credits to cover the excess. This system aims to encourage companies to invest in cleaner technologies and practices to reduce their emissions cost-effectively.

Carbon credits operate within two main frameworks: regulatory (compliance) markets and voluntary markets.

Carbon credits are generated through various means, including renewable energy projects, methane capture from landfills or livestock, reforestation, and energy efficiency improvements. Projects are verified and validated by third-party organizations to ensure they meet specific standards and criteria, including additionality, permanence, and verifiability.

Carbon credits provide a flexible mechanism for reducing global emissions, creating financial incentives for emission reductions, and facilitating investment in green projects. However, they also face scrutiny over issues like the effectiveness of emission caps, the potential for market manipulation, and ensuring the integrity and additionality of emission reduction projects.

Though often conflated, carbon offsets and carbon credits serve different purposes and function within different contexts.

In summary, while carbon offsets and carbon credits both play critical roles in addressing climate change, they operate under distinct paradigms with unique objectives, methods, and challenges. Understanding these differences is crucial for effectively leveraging these mechanisms towards achieving global sustainability and emission reduction goals.

Carbon offsets and credits are integral components of global strategies to mitigate climate change. By providing mechanisms for financing emission reduction projects, they play a pivotal role in transitioning towards a low-carbon economy. Offsets allow entities that are unable to reduce their emissions directly to support external projects that achieve equivalent reductions, thus promoting sustainable development practices, from renewable energy to reforestation. Carbon credits, particularly in regulatory markets, create a financial incentive for major emitters to invest in cleaner technologies and reduce emissions to avoid the costs of purchasing additional credits.

Both instruments have been criticized and applauded for their roles in climate change mitigation. Critics argue that reliance on offsets and credits may detract from the urgent need for direct emission reductions at the source. However, proponents highlight their effectiveness in channeling funds into climate-positive projects and stimulating innovation in green technologies.

The ethical considerations surrounding carbon offsets and credits often center on issues of environmental justice and the potential for “greenwashing,” where companies may claim to be more environmentally friendly than they are by purchasing offsets or credits instead of reducing their own emissions. The integrity of these mechanisms depends on strict standards, transparency, and third-party verification to ensure that projects deliver real, additional, and permanent emission reductions.

There’s also a debate on the distribution of projects, with some communities benefiting from the investments while others may not see as direct an impact. Ensuring that these mechanisms contribute to equitable, sustainable development is an ongoing challenge.

The regulatory and policy frameworks governing carbon offsets and credits are complex and varied, involving international agreements, national laws, and voluntary standards. Internationally, the Paris Agreement under the United Nations Framework Convention on Climate Change (UNFCCC) provides a global framework for reducing emissions, within which offsets and credits can play a role. Nationally, countries may implement their own carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, which define the creation and use of carbon credits.

Voluntary standards for carbon offsets, such as the Verified Carbon Standard (VCS), Gold Standard, and Climate, Community & Biodiversity Standards (CCBS), ensure projects meet high levels of environmental integrity and contribute to sustainable development. These standards are critical for maintaining trust in the voluntary offset market.

Compliance with regulatory requirements and adherence to high-quality standards are essential for the effectiveness and credibility of carbon offsets and credits. This compliance ensures that these mechanisms lead to verifiable, real, and additional emission reductions. Regulatory frameworks often include mechanisms for monitoring, reporting, and verification (MRV) to ensure transparency and accountability.

Moreover, the evolving nature of these frameworks means that offsets and credits must continually adapt to stricter guidelines and emerging best practices. This evolution is crucial for enhancing their role in climate change mitigation and ensuring they contribute positively to global emission reduction efforts.

The growing awareness of climate change has led to an increased interest in how individuals and corporations can contribute to carbon reduction efforts. For individuals, this might involve calculating their carbon footprint to understand their personal impact and purchasing carbon offsets to neutralize it. Many online calculators and platforms enable individuals to support projects that align with their values, such as renewable energy, reforestation, or community-based sustainability initiatives.

Corporations, on the other hand, engage in these mechanisms both voluntarily and as part of compliance with regulatory requirements. Many companies set ambitious carbon neutrality or net-zero emissions goals, incorporating carbon offsets and credits as part of their sustainability strategies. This can also involve internal reductions through efficiency improvements, renewable energy investments, and changes in supply chain management. By participating in carbon markets, companies can not only mitigate their environmental impact but also demonstrate leadership in sustainability, enhancing their brand reputation and meeting the expectations of customers, investors, and regulators.

For both individuals and corporations, the effectiveness of participation in carbon offsetting or credit schemes depends on making informed decisions. This entails a thorough evaluation of the projects or credits being considered, including their certification standards, project longevity, additionality, and overall impact. Transparency and third-party verification are crucial in ensuring that these investments genuinely contribute to emission reductions and sustainable development.

Moreover, awareness extends to understanding the limitations of offsets and credits. Recognizing that these mechanisms are not a panacea but rather a part of a broader array of actions needed to tackle climate change is essential. Direct emission reductions through lifestyle changes, corporate practices, and policy advocacy remain critical.

Public engagement with carbon offsets and credits can drive demand for more stringent environmental standards and transparency in the carbon market. Educated consumers and corporations can advocate for policies that strengthen the integrity of carbon offsetting and trading schemes, ensuring they play a constructive role in the global response to climate change.

Additionally, widespread participation and demand for carbon offsets and credits can stimulate further investment in renewable energy, conservation projects, and other initiatives critical for a sustainable future. As awareness grows, so does the potential for these mechanisms to support a comprehensive approach to reducing global greenhouse gas emissions.

The exploration of carbon offsets and credits reveals their complex yet crucial roles within the broader strategy to combat climate change. While each operates within distinct frameworks and serves different purposes, together they represent important mechanisms for financing emission reduction projects and incentivizing a shift towards a low-carbon economy. The effectiveness of carbon offsets and credits hinges on rigorous standards, transparent practices, and a collective commitment to environmental integrity.

Looking forward, the continued evolution and integration of carbon offsets and credits into global climate strategies will be essential. Enhancing the transparency, accountability, and integrity of these mechanisms will ensure they contribute effectively to emission reduction goals. Moreover, as public awareness and participation grow, so does the potential for these instruments to drive meaningful action towards a sustainable future.

The challenge remains to balance the reliance on offsets and credits with the imperative for direct emission reductions across all sectors of the economy. Achieving global climate targets, such as those outlined in the Paris Agreement, will require a multifaceted approach that includes both innovative market-based solutions like carbon offsets and credits and substantial direct investments in renewable energy, energy efficiency, and other low-carbon technologies.

The journey towards a sustainable, low-carbon future is complex and challenging, yet essential for the health of our planet and future generations. Carbon offsets and credits, despite their limitations and the debates surrounding their use, play a significant role in this journey. By continuing to improve and critically evaluate these mechanisms, we can ensure they serve their intended purpose: to accelerate the transition to a more sustainable world and help mitigate the impacts of climate change.

09/02/2024

Discover the essentials of carbon accounting, a key strategy in the fight against climate change.

11/02/2024

Understanding the different types of carbon emissions is crucial. Luckily, they’re categorized into three different scopes.

06/11/2023

Accelerate Europe's clean energy transition through carbon taxes and RECs, regulated tools for a greener future.